Fleet Total Cost of Ownership Explained

What is Total Cost of Ownership (TCO)?

We often mentioned TCO in our news updates yet we are aware that TCO can mean something different depending on your view point so we thought we would explain how we think about it when undertaking our Fleet Consultancy Work.

How is it Calculated?

For the most effective TCO methodology you should bring together the key costs of running your fleet such as Business Lease Costs, Fuel, Taxation, Maintenance, Insurance and Accident spend to ascertain the total running cost of vehicles and fleet, once this is done it makes different vehicles, products and services much easier to evaluate and compare.

The simple task of calculating TCO is a great way to compare vehicles as it allows car lease comparison by a single cost figure, which is especially helpful when comparing Electric Vehicle Leasing against Combustion Engine Vehicles for example.

These factors vary but generally include:

- Business Car lease Costs

- VAT Disallowance

- Fuel Spend (Business Miles only)

- Maintenance (Budgeted spend works best)

- National Insurance Costs

- Vehicle Insurance

- Corporation Tax Including Leasing Disallowance

TCO can also apply to commercial vehicles and is simpler to do as the company van taxation regime is more straight forward.

TCO brings into focus all the costs associated with each company vehicle, allowing a better understanding of the total cost of running that vehicle. Looking at one figure, rather than looking at costs in silos without ever consolidating them to one cost line, means a tighter focus on spend and value.

TCO Impact on Enployees

By implementing a TCO approach this also takes into account the driver tax position through company vehicle BIK and will naturally drive more tax efficient vehicles into company vehicle policies and exclude high TCO options, a win-win for employer and employer.

TCO in Action

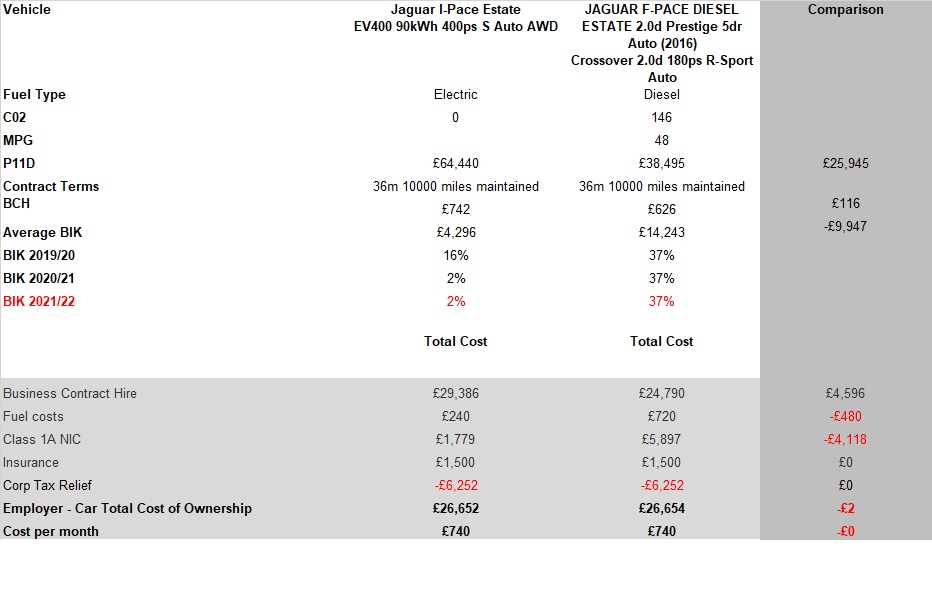

Here is an example of 2 similar SUVs from Jaguar, one I-Pace and one F-Pace.

As you can see despite the fact these 2 vehicles have headline lease rates which are £116 different the TCO is identical at £740 a month.

Benchmarking & Benefits in International Fleet Consulting

One of the main benefits in applying a TCO approach to Fleet Consutlancy is the ability to benchmark vehicles and fleets and enable easy comparison to other fleets whether they are part of the same company, in different countries or even competitors.

This benchmarking enables businesses to easily compare fleet spend, identify fleet optimisation opportunities and then track savings initiatives to ensure cost optimisations are identified.

Summing Up

With the changing state of company vehicle BIK tax, alternative fuel vehicles including Electric Vehicles its now more important than ever for businesses to employ some form of TCO when selecting company vehicles as the impact of making the incorrect decision could run into thousands of pounds per vehicle per year and hundreds of thousands across your fleet.

Our Business car lease TCO model has values for every quotable vehicle so just let us know what you are looking for and we can do the car lease comparison for you and build up a TCO position on your business fleet, you can also find out more here.

Interested in Finding out more? LetsTalk on 0330 056 3335