Company Car Tax Changes 2018

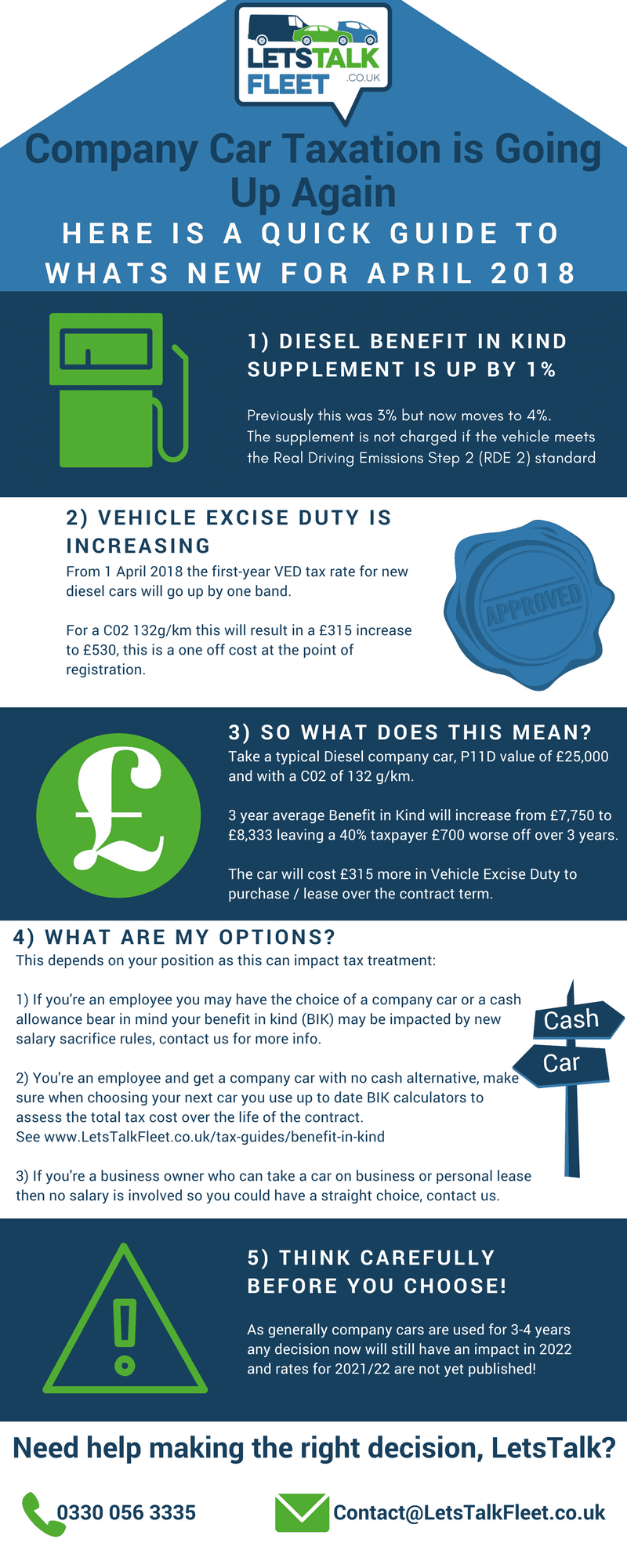

Company car tax and first year vehicle excise duty are increasing in April 2018, both these changes could result in company vehicles costing more for employers, employees or both.

If you are an employee who has a cash versus car decision for their next car lease are you aware how this impacts you? Our data shows that for many vehicles making the incorrect Business v Personal Lease decision could cost thousands over the life of the vehicle contract.

Our quick reference guide below highlights the changes and shows how these impact a typical fleet vehicle.

By using our bespoke Cash Versus Car decision making model which is tailored to your inidividual circumstances we can produce an individual statement for you which will help guide you towards the right decision for you.

Whether you are a fleet operator, business owner or an employee with a company car option we can help you make your personal car lease or business contract hire decision, LetsTalk.